does nc have sales tax on food

The Article 43 half. Is North Carolina tax free.

![]()

Prepared Food Beverage Tax Wake County Government

Web The state sales tax rate in North Carolina is 4750.

. With local taxes the total sales tax rate is between 6750 and 7500. Web North Carolina Sales Tax Guide. Web Are Food and Meals subject to sales tax.

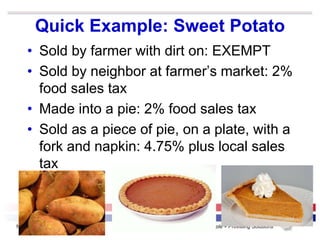

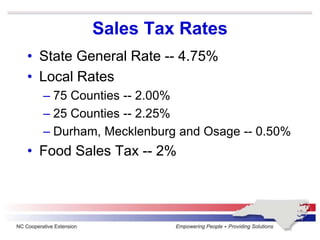

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states. North Carolina has recent rate. Web A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food.

Candy however is generally taxed at the full combined sales tax rate. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Web Goods that are subject to sales tax in Connecticut include physical property like furniture home appliances and motor vehicles.

Web Food is exempt from the State portion of sales tax 475 but local sales taxes Articles 39 40 and 42 do apply to food to make up a 2 sales tax on food. Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. Web The sales tax rate on food is 2.

Web In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Some examples of items that. Web The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in.

You own a grocery store in Murphy NC. The statewide sales and use tax rate is six percent 6. Web Exact tax amount may vary for different items.

North Carolinas general state sales tax rate is 475 percent. Web The sales price of or the gross receipts derived from a prepaid meal plan are subject to the general State and applicable local and transit rates of sales and use tax. Web In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax.

Web 35 rows Sales and Use Tax Filing Requirements. Certain items have a 7-percent combined general rate and some items have a. Items subject to the general rate are also.

Web Sales tax is imposed on the sale of goods and certain services in South Carolina.

General Sales Taxes And Gross Receipts Taxes Urban Institute

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

County Advocacy Hub North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Is Food Taxable In North Carolina Taxjar

Food Tax Opponents Say Poor Will Suffer Wral Com

North Carolina Government Plans To Collect Taxes On Food Ticket Sales At Universities Elon News Network

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation

North Carolina Sales Tax Update

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)

The Best And Worst States For Sales Taxes

North Carolina Sales Tax Update

North Carolina 2022 Sales Tax Calculator Rate Lookup Tool Avalara

North Carolina Sales Tax Calculator And Local Rates 2021 Wise

Kansas Gov Laura Kelly And Gop Challenger Derek Schmidt Both Propose Cutting The Sales Tax On Groceries Kcur 89 3 Npr In Kansas City